At this point we've seen natural disasters, geopolitical tensions, and economic uncertainties constantly threaten the seamless flow of necessary components. With this, the cost to maintain a solid supply chain has continued to inflate, leaving procurement experts on a constant search for reduction opportunities. It's stressful, we know. But we can...

You’ve done your research and have decided Mexico looks like a compelling place to manufacture your product. Maybe you’re looking to move your production to gain a competitive advantage with new pricing as your volumes increase, or perhaps you’ve realized the need to diversify and reduce your supply chain risk.

Current Georgia Tech student and engineering co-op participant, Charlotte Meyers, shares below how her experience at East West has benefitted her growth as an engineer and has provided hands-on educational opportunities that will prepare her for a successful career after graduation.

How A Vertically Integrated Manufacturer Enhances Stability

Some manufacturers stand out for their expertise in prototyping, while others shine in producing high-quality goods at scale. Yet, there exists a category of manufacturers whose approach involves optimizing operations to offer customers comprehensive production capabilities throughout the entire product lifecycle under one overarching umbrella....

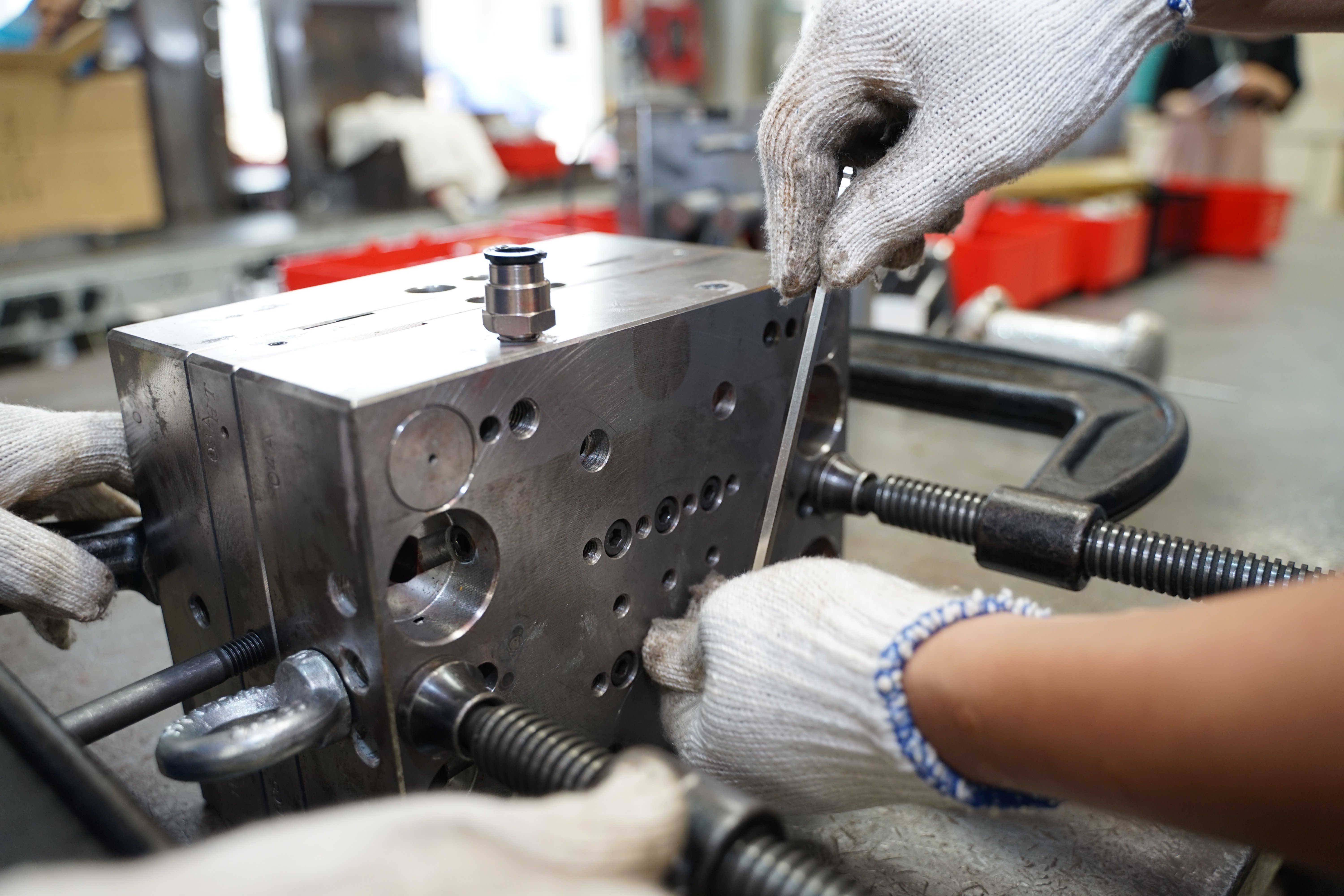

How Small Design Changes Can Affect Product Development Pricing

You’ve submitted your design, you’ve seen your prototype and… there’s something not quite right. Maybe a curve is deeper than expected, there’s a ridge or dimple where there shouldn’t be. Perhaps it just doesn’t feel the way you expected it to. But it’s a simple fix, right?

Smart factories, also known as Industry 4.0 or the fourth industrial revolution, represent a new era in manufacturing characterized by the integration of advanced technologies to enhance efficiency, productivity, and flexibility. These factories leverage technologies like the Internet of Things (IoT), artificial intelligence (AI), big data,...

Nearshore Supply Chains Winning As Ocean Freight Rates Skyrocket

The importance of diversifying supply chains has never been more evident than in the face of recent challenges. In the aftermath of the chaotic events of 2020, what was once considered an optional, but wise risk mitigation strategy has now become an absolute necessity. Despite the clear benefits, many companies remain apprehensive about shifting...

Human-Machine Interface (HMI) plays a pivotal role in bridging the gap between humans and machines. As our interactions with complex systems evolve, so does the landscape of HMI, offering a diverse range of interfaces tailored to different needs and contexts. We can separate the various types of HMI into the following main categories.

Supply chain visibility (SCV) is the ability of parts, components or products in transit to be tracked from the manufacturer to their final destination. According to TechTarget, the primary objective of SCV is to improve the availability of data to stakeholders and customers alike, ultimately strengthening and improving the supply chain.

Because n...

The Differences Between Tactile and Non-Tactile Membrane Switches

The user interface for any electronic device is a critical component that bridges the gap between human interaction and machine functionality. Membrane switches, a universal technology in this domain, play a crucial role in creating intuitive and responsive interfaces. Two prominent variants of membrane switches—tactile and non-tactile—offer...

.jpg?width=176&height=56&name=MR_associatedNetwork_logo%20(1).jpg)