Whether you are brand new to international shipping or just need a refresher on the ins and outs of Incoterms, we have you covered. International freight a complex business, so it's important to understand the industry lingo, associated risks and costs, and how it all affects you.

What Are ICC Incoterms 2010?

International Commercial Terms (also known as Incoterms) are the standardized rules laid out by the International Chamber of Commerce (ICC) which explain the most commonly used international trade terms. Incoterms were established in 1936 to avoid misunderstandings or misinterpretations between different countries. Their goal is to clearly communicate the costs, risks and responsibilities related to the transportation of goods. The terms are updated as changes in international trade occur; amendments were made in 1953, 1967, 1976, 1980, 2000 and 2010.

Incoterms 2010 defines 11 rules, which are broken down into two categories based on method of delivery: 1) all modes of transport and 2) sea and inland waterways only. While you could technically use Incoterms 2000 instead of 2010, we would discourage you from doing so to avoid confusion.

3 Reasons to Care about Incoterms

Do you want to have fewer work-related headaches?

Understand and use Incoterms correctly!

If you're operating a global company — buying, selling, shipping — you need to know what you're talking about when it comes to Incoterms, and here are three reasons why:

- Incoterms ensure that everyone is on the same page. Buyers and sellers can reference a standardized rule with clearly defined responsibilities, costs and risks.

- Standardization reduces the risk of legal issues since everything is outlined clearly and there is no room for interpretation or he-said/she-said games.

- While Incoterms do not mention pricing, they do help buyers and sellers understand which tasks each party is responsible for so there are no expensive surprises along the way.

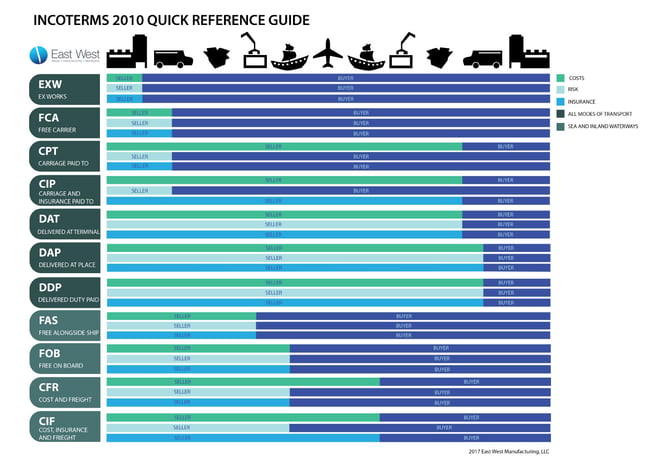

Where Can I See an Incoterms 2010 Chart?

How about right here?

Click on the image to open larger.

What do Incoterm Acronyms Mean?

We can just hear you, "That's a very nice chart but I have no idea what any of those acronyms mean." Fortunately, we've listed the definitions below. There are many governmental and shipping websites where you can find Incoterm information.

Again, the acronyms break down into two categories "Any Mode of Transport" and "Sea & Inland Waterways." The definitions listed come to us courtesy of the export.gov website.

ANY MODE OF TRANSPORT

- EXW (Ex Works)

The seller delivers when it places the goods at the disposal of the buyer at the seller’s premises or at another named place (i.e.,works, factory, warehouse, etc.). The seller does not need to load the goods on any collecting vehicle, nor does it need to clear the goods for export, where such clearance is applicable. - FCA (Free Carrier)

The seller delivers the goods to the carrier or another person nominated by the buyer at the seller’s premises or another named place. The parties are well advised to specify as clearly as possible the point within the named place of delivery, as the risk passes to the buyer at that point. - CPT (Carriage Paid To)

The seller delivers the goods to the carrier or another person nominated by the seller at an agreed place (if any such place is agreed between parties) and that the seller must contract for and pay the costs of carriage necessary to bring the goods to the named place of destination. - CIP (Carriage and Insurance Paid To)

The seller delivers the goods to the carrier or another person nominated by the seller at an agreed place (if any such place is agreed between parties) and that the seller must contract for and pay the costs of carriage necessary to bring the goods to the named place of destination. The seller also contracts for insurance cover against the buyer’s risk of loss of or damage to the goods during the carriage. The buyer should note that under CIP the seller is required to obtain insurance only on minimum cover. Should the buyer wish to have more insurance protection, it will need either to agree as much expressly with the seller or to make its own extra insurance arrangements.

- DAT (Delivered at Terminal)

The seller delivers when the goods, once unloaded from the arriving means of transport, are placed at the disposal of the buyer at a named terminal at the named port or place of destination. “Terminal” includes a place, whether covered or not, such as a quay, warehouse, container yard or road, rail or air cargo terminal. The seller bears all risks involved in bringing the goods to and unloading them at the terminal at the named port or place of destination. - DAP (Delivered at Place)

The seller delivers when the goods are placed at the disposal of the buyer on the arriving means of transport ready for unloading at the named place of destination. The seller bears all risks involved in bringing the goods to the named place. - DDP (Delivered Duty Paid)

The seller delivers the goods when the goods are placed at the disposal of the buyer, cleared for import on the arriving means of transport ready for unloading at the named place of destination. The seller bears all the costs and risks involved in bringing the goods to the place of destination and has an obligation to clear the goods not only for export but also for import, to pay any duty for both export and import and to carry out all customs formalities.

RULES FOR SEA AND INLAND WATERWAY TRANSPORT

- FAS (Free Alongside Ship)

The seller delivers when the goods are placed alongside the vessel (e.g., on a quay or a barge) nominated by the buyer at the named port of shipment. The risk of loss of or damage to the goods passes when the goods are alongside the ship, and the buyer bears all costs from that moment onward. - FOB (Free on Board)

The seller delivers the goods on board the vessel nominated by the buyer at the named port of shipment or procures the goods already so delivered. The risk of loss of or damage to the goods passes when the goods are on board the vessel, and the buyer bears all costs from that moment onward. - CFR (Cost and Freight)

The seller delivers the goods on board the vessel or procures the goods already so delivered. The risk of loss of or damage to the goods passes when the goods are on board the vessel. the seller must contract for and pay the costs and freight necessary to bring the goods to the named port of destination. - CIF (Cost, Insurance and Freight)

The seller delivers the goods on board the vessel or procures the goods already so delivered. The risk of loss of or damage to the goods passes when the goods are on board the vessel. The seller must contract for and pay the costs and freight necessary to bring the goods to the named port of destination.

The seller also contracts for insurance cover against the buyer’s risk of loss of or damage to the goods during the carriage. The buyer should note that under CIF the seller is required to obtain insurance only on minimum cover. Should the buyer wish to have more insurance protection, it will need either to agree as much expressly with the seller or to make its own extra insurance arrangements.

Hopefully this post helps clarify what Incoterms are, especially when and how they're used. Remember: standards, like Incoterms, are meant to ease transactions and keep the wheels of commerce turning — and that's a good thing!

.jpg?width=176&height=56&name=MR_associatedNetwork_logo%20(1).jpg)